Search

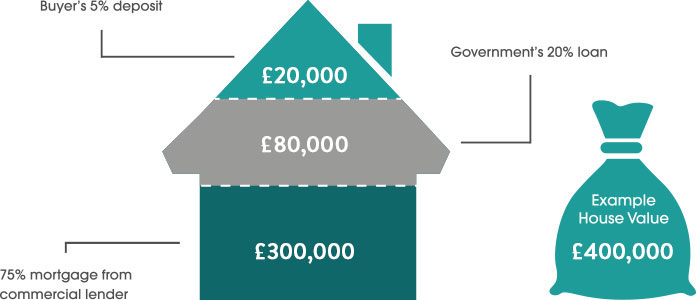

As a buyer, it means you now need to borrow a much lower amount than before. Assuming you have a 5% deposit (£20,000 on a £400,000 purchase price) the fact that you now only need to borrow 75% of the mortgage compared to 95% without Help to Buy means you will get a much better interest rate and it becomes much more accessible to those on lower incomes.

Help to Buy was restricted to just first time buyers, but now existing homeowners can also benefit if the new build property you are purchasing under the scheme is your only residence and as long as you are not entering the scheme with the aim of renting it out in the future.

After the five year interest-free period has ended, the loan has to be repaid or interest is charged at 1% over Retail Price Index (RPI) – currently this is calculated at 1.75%. Alternatively, if you have saved or re-mortgaged you can pay the loan off, based upon the percentage borrowed of the current market value.

Help to Buy in its current form is due to run until the end of March 2021 by which date completion on your new home purchase must have taken place. After this date the Help to Buy scheme will only be available to First Time Buyers and will be capped at a purchase price of £437,600 in the south east of England and £600,000 in the London area.

As a developer, if you are not already registered with the Government Help To Buy scheme, we can provide expert guidance and advice on how to register and submit applications to help you find the right buyer more quickly.