Search

Property

When a family member or loved one dies, dealing with the sale of their property can be very difficult to start thinking about.

Thankfully it’s not something most of us have to contend with frequently, but it’s because of this, the process can seem daunting. Yes, some people decide to take on the process of Probate themselves, but there is great value in appointing a specialist lawyer, not only to make your life easier at such a distressing time but also to alert you to any potential financial wrong turns along the way, especially when it comes to having your property valued for Probate purposes.

Probate Definition: the legal and financial processes involved in dealing with the property, money and possessions (the estate) of a person who has died. Before the next of kin or Executor named in the Will can claim, transfer, sell or distribute any of the deceased’s assets they may have to apply for Probate.

If you are in a position where you need to gain Probate for a loved one’s estate, we’ve prepared this short guide to help you through the Probate process:

Before you can obtain a Death Certificate you will need to Register The Death. You will need several copies of the Death Certificate which can be obtained when you register the death.

You will need to find out whether or not the Deceased left a Will. If there is a Will the named Executors will need to apply for a Grant of Probate to administer the estate. If there is no Will the Deceased has died “intestate” and the next of kin will need to apply for a Grant of Letters of Administration to deal with the estate.

A good Probate Solicitor can manage the whole process for you to ensure Probate is obtained quickly and efficiently and in some cases, they can help to reduce the overall tax liability.

Lodge Brothers Legal Services are our preferred Solicitor we recommend to our clients for Probate, offering fixed fees and a range of Probate packages with different levels of service for all budgets.

Each and every financial establishment the deceased was engaged with before their death needs to be contacted to obtain the date of death values of their financial assets (savings or investments) or liabilities (debts). This is something that you probate Solicitor can assist with.

Ascertaining the full extent of the deceased’s assets often involves the need to find out the value of any property contained within their estate.

Property Probate Valuations need to be done by expert Estate Agents in collaboration with your legal advisers.

It is really important to obtain a Probate Valuation from an Estate Agent that is familiar with the Probate process and works together with your legal adviser. At Curchods, we work closely with the Solicitors at Lodge Brothers Legal Services to ensure that we provide an accurate Probate valuation that takes into account the tax situation of the deceased’s estate.

Valuing a property is not a precise process and any property can have a range of values attributed to it. So a property’s true open market value can only be known when a sale is completed.

We always suggest that when you have your property valued that you ask the opinion of three different Estate Agents. It is a common practice for Estate Agents who don’t fully understand the Probate process, to give a lower valuation on the basis that this will help reduce Inheritance Tax. However, with the recent introduction of the ‘Residence Nil Rate Band’ many estates are no longer liable to Inheritance Tax where they would have been in the past.

Where an estate is not liable to Inheritance Tax it is much better to have a Probate valuation that reflects the highest possible selling price that may be achieved.

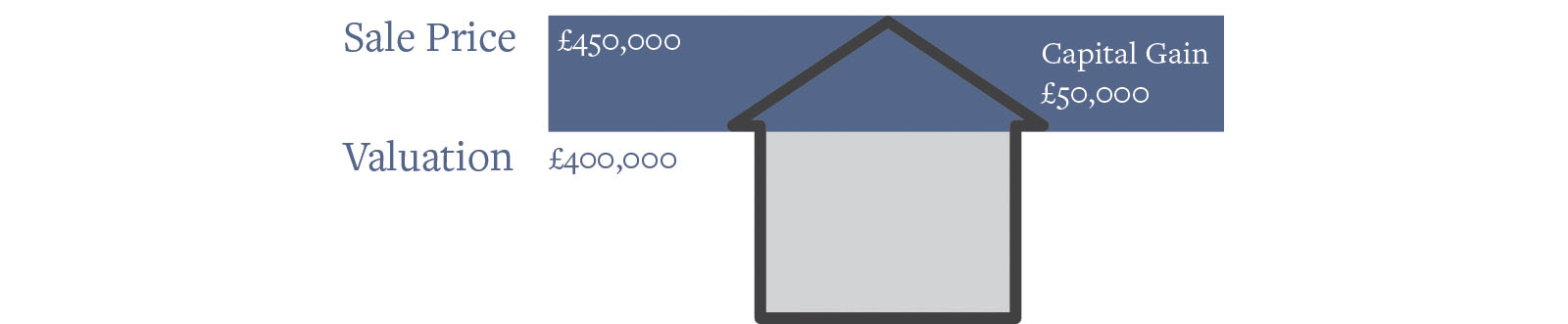

If a low valuation is given for Probate purposes and the property is then sold at a higher price, the difference in price between the Probate value and the actual selling price may be subject to Capital Gains Tax.

For example, if a Probate Valuation of £400,000 is given and the selling price is £450,000 there is a capital gain of £50,000 which will be subject to Capital Gains Tax.

Whereas, if the higher value of £450,000 had been used there would have been no Inheritance Tax or Capital Gains Tax payable.

If an estate is subject to Inheritance Tax it is helpful to enter a lower but more realistic value for Probate purposes so that if the value is agreed by the District Valuer, the Inheritance Tax payable will be lower. If the value is agreed and the property subsequently sells for more, there may be Capital Gains Tax to pay but this is at a lower rate than Inheritance Tax.

For these reasons, it is important that careful consideration is given to the particular circumstances of the estate when providing a property Probate Valuation.

Your appointed Probate Solicitor will then establish how much Inheritance Tax, if any, should be paid on the estate and send off the appropriate forms to HMRC.

Your Solicitor will complete all the Probate papers and apply for the Grant of Probate on your behalf. Lodge Brothers Legal Services are our preferred solicitor who we recommend to our clients for Probate purposes, they charge fixed fees and offer a range of Probate Packages for all budgets. Sophie Andrews of Lodge Brothers Legal Services can be contacted on 020 3540 6658 or email legalservices@lodgebrothers.co.uk

More Articles