Search

Selling

As a seller, getting the asking price right when your property is launched to the market is a key factor as to how quickly you will find a buyer and the eventual sale price you will achieve.

Setting the correct asking price is possibly the most critical part of marketing your home, so if you are thinking of selling, this article will help you understand what is happening with house prices as of September 2020 and guide you towards setting an asking price that will help you achieve your goals.

Typically when you come to sell your home, the first step is to have it valued by a reputable local estate agent, but before this happens most savvy sellers will have been online and guestimated their own prediction of what their property is worth, to be able to sense check the figure presented by the estate agents that visit.

The correct ‘asking price’ will be unique to your individual property and can’t accurately be determined by online tools, as only a virtual or physical valuation of your home, will allow the valuer to assess its conditions and any improvements you may have made. For this reason, asking prices can even vary significantly down the same road.

When you place your property on the market, whether you choose a high or low asking price will come down to simply supply and demand economics and will change depending on whether it is a buyer’s or a seller’s market.

When setting an asking price it is important to decide the amount that you would like to achieve and the figure that you are prepared to accept. Having a clear idea of these at the outset will help you to price your home and also make your agents negotiations with buyers more straightforward. Being realistic is key.

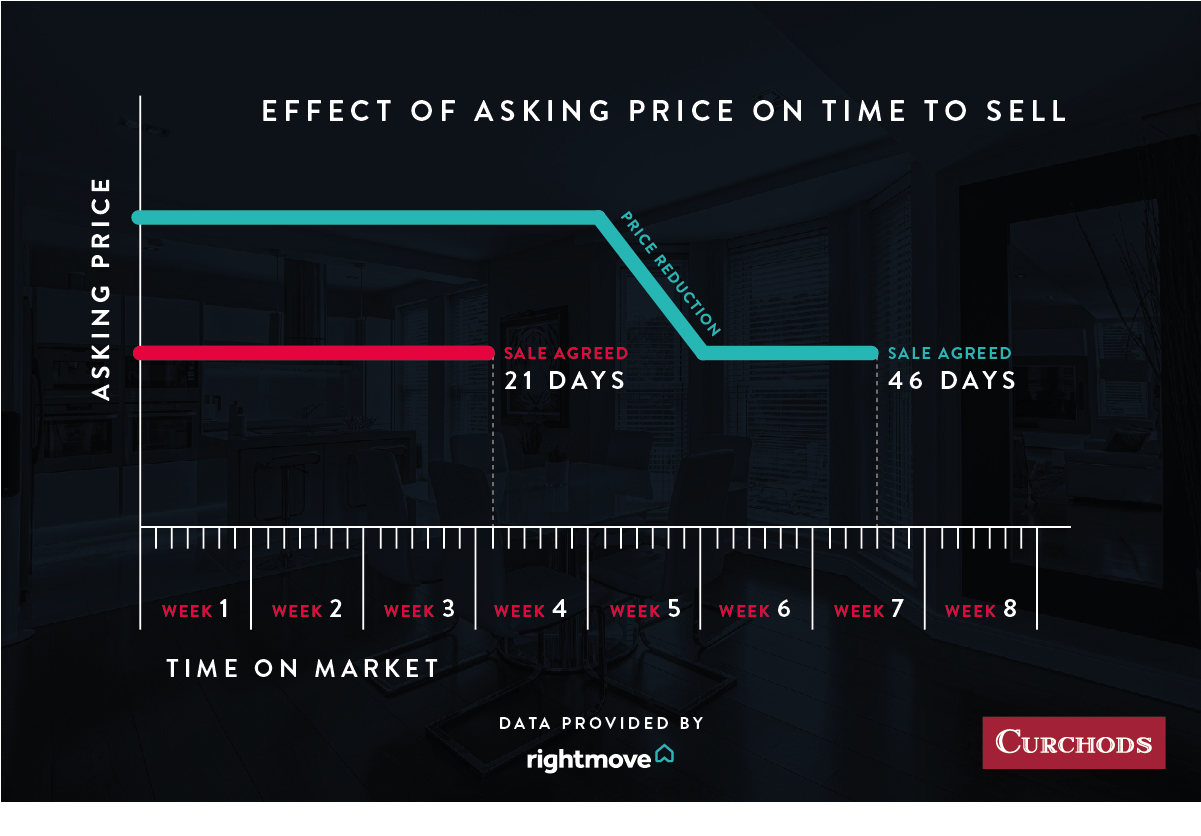

When it comes to setting an asking price, getting the right figure is always going to be a balance between how much you want to achieve and how long it will take to sell. Set the asking price too low and you’ll sell quickly but lose money, set it too high and it will take longer to sell.

Rightmove recently reported that asking prices hit a record high in July this year, with the 3.7% annual rate of increase being the highest for over three and a half years.

Seeing the trends of rising asking prices being reported in the media, there is the temptation to try to inflate your asking price which is where we need to issue a note of caution – going too far could mean your property takes longer to sell or will need to be reduced in price in the future.

In a recent Rightmove survey the average time it takes to find a buyer from when the property is first listed for sale is 21 days.

For those properties that have gone onto the market, but have later needed to be reduced before they found a buyer, the average time on the market is 47 days. This shows that over priced properties that later needed to be reduced take on average an additional 26 days to find a buyer.

A recent Rightmove study of 300,000 newly-listed homes across four months shows sellers are twice as likely to find a buyer for their home if they have an offer accepted on the first listed asking price than those that needed to be reduced.

Curchods work hard to accurately price properties in order to agree a sale in the optimum time frame. On the valuation appointment we will give sellers an indication of the likely buyer demand, current market trends and present similar properties nearby which have recently sold so that sellers can be confident the price we suggest will achieve their objectives.

“In the current market, as long as the property is priced correctly Curchods typically take between 3 – 4 weeks to find a buyer.”

In Surrey and south west London, the balance between the supply of properties coming to the market and demand from buyers is fairly balanced at present, meaning now is not the time to over-inflate asking prices in the hope of striking it lucky.

Such is the intensity of activity, homeowners are being advised to find a buyer for their own home before starting their search. The result is that many of the sellers we present to buyers are in a good position to purchase and are extremely motivated due to a number of factors:

Rightmove is telling sellers that there is currently a window of opportunity for them to come to market and to find a buyer who is tempted by the Stamp Duty savings. However, the best way for sellers to capitalise on this demand is to price their properties accurately to ensure they strike the right balance between asking price and time to agree a sale.

“While property is selling much faster than a year ago, it’s important not to over-price and miss this window. It’s still a price sensitive market with buyers having limits on what they are able to borrow, and the uncertain economic outlook making them more cautious. – Miles Shipside, Rightmove”

The Stamp Duty Holiday is without doubt providing a boost to the market, but sellers are cautioned that they still need to price with the current market in mind.

Rightmove’s resident data expert Tim Bannister explained that pricing your property right could be the difference between completing a sale before the stamp duty deadline or not. He said:

“This analysis shows just how vital it is that sellers listen to their agent when they recommend the asking price that the property should be listed at. If sellers are serious about selling, then starting with too high an asking price can cause unnecessary delays, and also make it a lot less likely they will actually find a buyer in the end.”

In summary, to find a buyer for your home quickly you need to price your property correctly and have the wheels in motion now to take advantage of the current high activity in the market.

Thinking of selling?

We would be delighted to provide you with advice specific to your individual property. All you need to do is simply request an up-to-date market appraisal of your home. This service is free and without obligation.

More Articles