Search

New Homes

Buying brand new means your home really is a blank canvas on which you can stamp your own personality, identity and style. There is also something incredibly emotive about the heady mix of smells that only a newly constructed property has… fresh paint, fresh cut timber, newly mixed cement, new carpets… together they conjure up a sense of a new beginning, a new direction – something that now more than ever, many of us may be looking for.

The house you choose to make your home comes down to personal preference and of course, budget. Whilst some prefer the resale market, many like the idea of being the first people to live in a property,but what are the other benefits to buying a new build?

Ready to buy a brand new home? Search our selection of more than 300 properties for sale throughout Surrey and south west London.

If buying a new build is the option for you, it’s good to get prepared and do your research. We explore some top tips that could make the process of buying your new home run that little bit smoother.

Take a look online and get to know the property developers in the area where you want to buy.

See if they are mentioned on forums and what people are saying about them, but don’t let it put you off completely, instead let these forums inform you of any potential issues you may need to be aware of.

Pay a visit to the developer’s other sites so you can get a feel for how they look, the quality of the build.

Explore the local area not just the development itself. Check out the local transport links, maybe try a trial run of your journey to work, walk to local facilities and generally investigate the local infrastructure to find out if it’s going to be right for you and your family.

Many developers offer fantastic incentives to differentiate them from other local developers so it’s always worth shopping around for good deals. Whether it’s stamp duty paid, Help to Buy, free furnishings, landscaped gardens or a car parking space, buying brand new gives you the best option for getting a good deal!

Help to Buy is the name of the Government programme that was introduced in 2013 with the aim of helping first time buyers onto the property ladder, but is now available exclusively for New Build properties priced up to £600,000.

Since its launch the Government has provided £7.39bn worth of funding to assist more than 145,000 buyers to purchase their own homes, 81% of these being First Time Buyers.

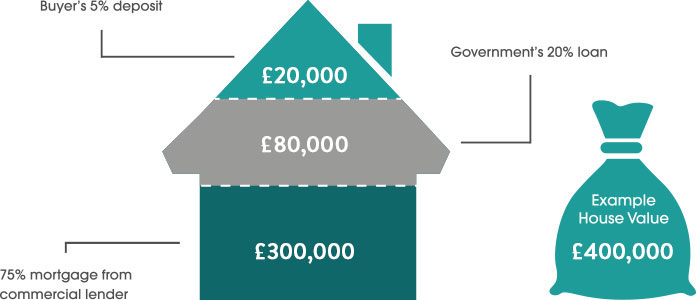

A summary of Help To Buy:

As a buyer, it means you now need to borrow a much lower amount than before. Assuming you have a 5% deposit (£20,000 on a £400,000 purchase price) the fact that you now only need to borrow 75% of the mortgage compared to 95% without Help to Buy means you will get a much better interest rate and it becomes much more accessible to those on lower incomes.

Help to Buy in its current form is due to run until the end of March 2021 by which date completion on your new home purchase must have taken place. After this date the Help to Buy scheme will only be available to First Time Buyers and will be capped at a purchase price of £437,600 in the south east of England and £600,000 in the London area.

Ready to buy a brand new home? Search our selection of more than 300 properties for sale throughout Surrey and south west London.

More Articles