Search

Property

If we look back to 2010, the UK was amidst the recovery operation following the Financial Crisis of 2008, under the stewardship of the Coalition Government run by David Cameron and Nick Clegg. Austerity measures to reduce public spending had been introduced and both house prices and the number of people moving were at their lowest levels for a long time after a sustained period of growth in the housing market since the recession of the early 1990’s.

In the last decade Curchods have gone from strength to strength. Since 2010 we agreed more than 17,000 property sales totalling £10bn worth of property.

Here is the story of the Surrey property market throughout the last decade:

• 2010: Rebuilding from Financial Crisis

• 2011: Curchods launch social media pages on Facebook and Twitter

• 2013: Help to Buy introduced

• 2014: Curchods launch Residential Lettings

• 2014: Mortgage Market Review launched

• 2014: Stamp Duty reform

• 2014: Curchods open sales branches in Kingston and Ham

• 2016: Stamp Duty surcharge on second homes introduced

• 2016: EU Referendum

• 2017: Tax relief changes for landlords

• 2017: Stamp Duty Land Tax cut for first time buyers

• 2017: Curchods launch in-house Conveyancing service

• 2018: GDPR introduced to protect consumer data

• 2019: Tenant Fees Act introduced

• 2019: Curchods launch award winning website and Client Portal

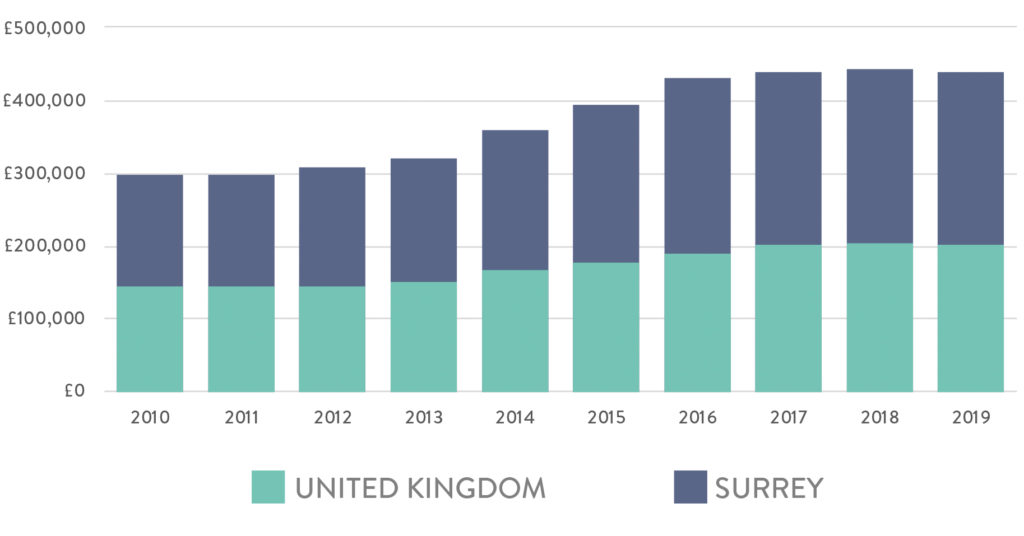

It may seem that house prices have been slowly creeping up, but if you look at the decade as a whole, house prices in Surrey have risen on average a staggering 55.5%.

[mbp_chart id=”15″]

This is absolute proof that property is still the best long term investment one can make. If you’re a homeowner this is good news, whilst first time buyers should be encouraged to take action as soon as possible to get onto the housing ladder and start enjoying the benefits and accumulated wealth of capital appreciation on their property purchase.

The average house price in Surrey has continued to rise throughout the decade from £288,713 in 2010 to £448,970 in 2019 and has consistently stayed close to double the national average property value in the UK.

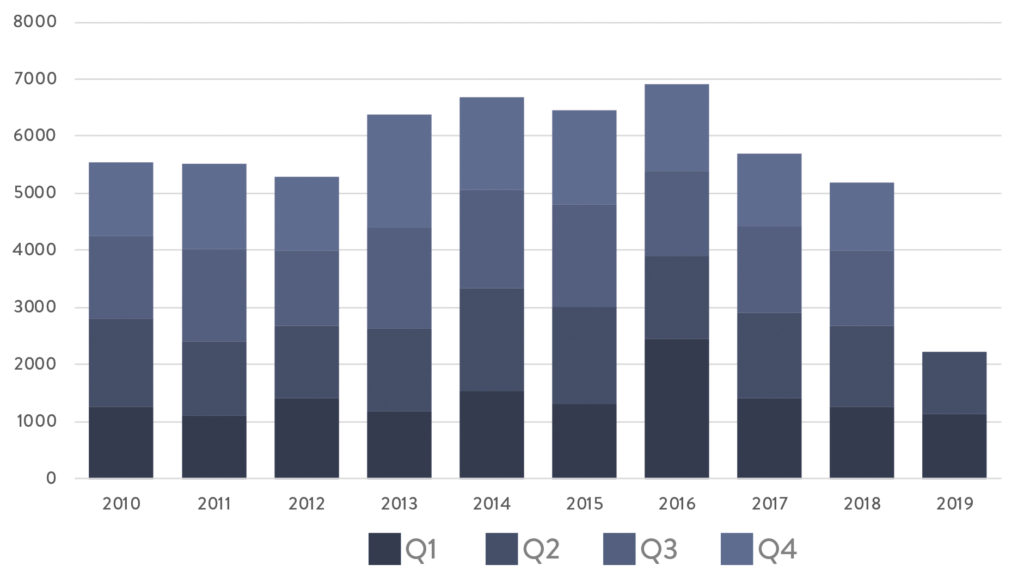

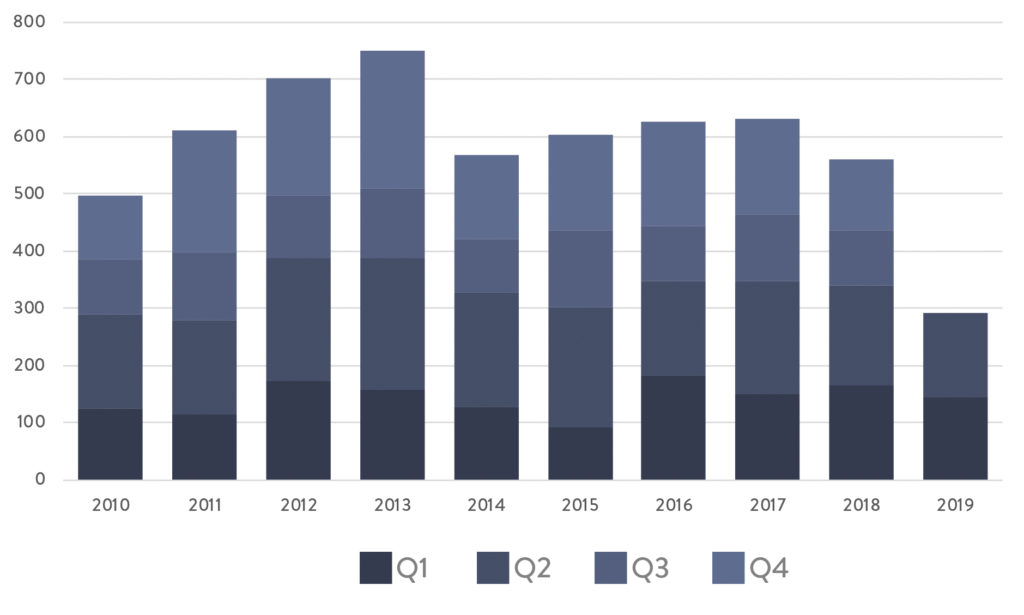

When it comes to the number of properties sold in Surrey, the main story in recent years has been Brexit. Transaction volumes were on an upward trajectory towards a pre-Referendum peak in 2016.

Since the EU Referendum, property sales have been subdued as many would-be house buyers and sellers have been waiting to find what path the country will take before taking action on their moving plans.

The result of the 2019 General Election and a majority Conservative Government provide a clear mandate for swift action on Brexit. As a result, we are expecting a strong bounce back in the number of buyers and sellers ready to commit to a move this spring, and with that a return in higher transaction volumes as we move into the next decade.

We are already seeing increased activity from buyers who are swiftly revisiting and increasing previous offers for properties on the market as they know a rise in house prices is just around the corner.

It’s fair to say we’ve been living through a technological revolution – in the last decade the number of internet users has increased from 1.97 billion to 4.39 billion in 2019.

In 2011 Curchods launched our Facebook, Twitter and Linkedin social media accounts, later to be followed by Youtube and Instagram to help us connect to a wider audience and give people an insight into the work we do for our clients.

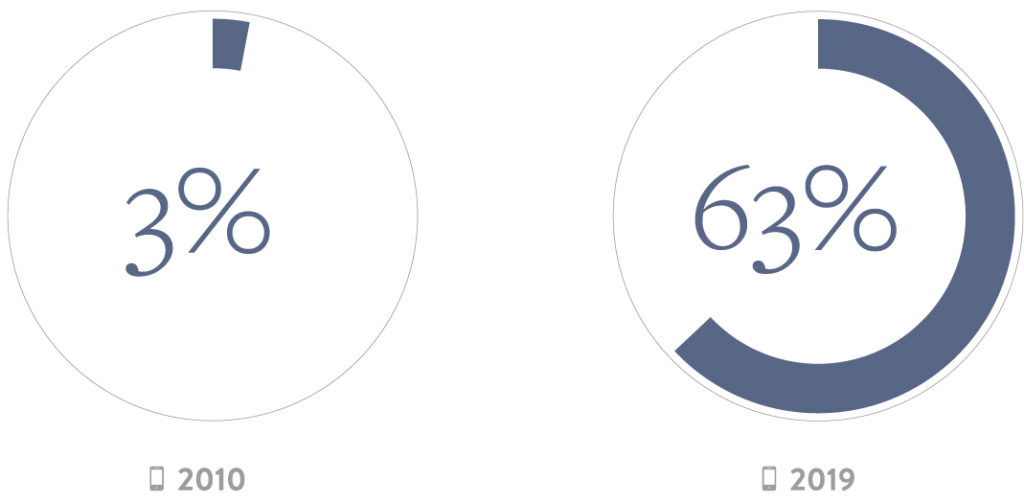

The iPhone 4 was unveiled in June 2010. Since then mobile phones have improved to the point where they are our go-to device for news, video and photo content. Smartphones have become ubiquitous throughout every age group and as a result, mobile internet usage has increased from just 3% in 2010 to 63% in 2019. This has meant a massive push on our behalf to keep up with these technological developments to ensure our clients’ properties are displayed at their very best online.

We’ve seen property advertising in newspapers diminish and a shift towards websites grow in popularity. As we head into the 2020’s the first place buyers go to search for properties is our own website and the leading property portals such as Rightmove, Zoopla and OnTheMarket. All these advances allow us to advertise properties faster and generate more enquiries than ever before.

Curchods now book photography for our clients online and send contract documents for signature by email. In 2019 we launched our award-winning new website which allows clients to book appointments with us online, alongside our exclusive MyCurchods Client Portal, which allows buyers and sellers to manage their property sale and search online.

The cost of borrowing has been cheap for the entire decade. Interest rates have been below 1% ever since 2010 which has caused competition between the major lenders trying to attract new business by offering the most competitive deal.

The knock-on effect has been some extremely low rates on offer throughout the decade. Lower interest rates mean lower monthly repayments and it’s cheaper than ever to borrow in order to purchase a property.

In 2016 Curchods Mortgage Services launched their fully interactive online FactFind and Secure Portal for document transfer and storage. This allowed a more interactive online experience for clients aiding in the speed of the whole mortgage process.

The financial crisis drove financial regulations to a new and fairly complex level. Since April 2014 Government legislation in the form of the Mortgage Market Review (MMR) made it mandatory for all mortgage applications to be undertaken by professionally qualified experts on a fully advised basis.

Each application is now subject to much more rigorous affordability checks. Surprisingly many bank and building society staff, who prior to MMR could advise and arrange mortgages for customers, are no longer adequately qualified to do so.

Over the course of the decade, Curchods Mortgage Services has helped more customers than ever before. As we are independent of any one lender and because all of our advisors are fully qualified with many years experience, it allows us to advise, research, prepare and submit mortgage applications on behalf of our clients.

Stamp Duty Land Tax (SDLT) is paid when you purchase a property, a system that has seen much reform in the last decade.

Until 2014, if the property was worth over £125,000, one would pay a percentage of the value of the property depending on what band it fell into. However, there were issues with this system. For example, a home costing £249,000 attracted a bill of £2,490, whilst one costing £250,001 attracted a bill of just over £7,500 – an unfair system that would encourage sellers to market their property just below the next SDLT band.

SDLT was reformed in 2014 so that it did away with the band structure and followed a system closer to income tax – so that the tax is only payable on the portion of the value in each bracket.

First time buyers received some good news this decade, as of November 2017, the Government ensured first time buyers pay no stamp duty on the first £300,000 (for property purchases up to £500,000).

• 0%: Up to £125,000 / First-time buyers: first £300,000 for property up to £500,000

• 2%: Over £125,000 to £250,000

• 5%: Over £250,000 to £925,000

• 10%: Over £925,000 to £1,500,000

• 12%: Over £1,500,000

Higher rates of Stamp Duty Land Tax (SDLT) have been charged on purchases of additional residential properties since April 2016, resulting in an additional 3% of SDLT being charged on second homes and buy-to-let properties.

In June 2019, the Tenant Fees Act came into force, banning fees paid by private tenants in England to landlords and letting agencies and capping the security deposits tenants have to pay at five weeks’ rent. The Act is designed to reduce the charges that tenants face from the very start of the renting process, throughout their tenancy and when their contract comes to an end, by getting rid of any hidden costs.

At the turn of the decade the Government set out a clear goal of building more new homes and in 2013 introduced the Help to Buy scheme to encourage the purchase of the new homes they were setting out to build.

Since it’s introduction in 2013, Help to Buy has helped buyers purchase 236,313 properties (June 2019) totalling £62 billion pounds worth of property throughout the UK.

With Government goals and purchase incentives in place, data from the National Audit Office (NAO) shows that since 2010 the number of new homes being built in the UK has been on an upward trend, rising from approximately 137,000 new homes constructed in 2010 to 222,000 last year (2018).

Despite the upward trend nationally for more new homes being built, in Surrey the number of new build properties being bought peaked in 2013 and has remained consistently lower since then.

*Source Land Registry

There have been some significant changes to Planning Regulations in the last decade. In 2010 the coalition Government delegated the responsibility of planning decisions to local authorities. A decision which was then reformed in 2015 as the Government took control of the planning process from local authorities.

In June 2017, the Grenfell tower tragedy had wide-reaching implications, forcing improvements in fire regulations within new builds and in some cases, changing external cladding on buildings to secure against a similar situation happening again.

It’s easy to forget just how much reform has been introduced in the housing sector in the last 10 years until you see it all in one place.

The lasting takeaway is how much of a good investment property in Surrey continues to be as we head into the 2020’s.

Despite Brexit dominating the latter part of the decade, house prices still rose 55%. With a limited supply of property available in Surrey at any one time, it’s good news for homeowners as house prices are only set to rise further. With this in mind, the advice for first time buyers is to get on the property ladder as soon as possible, especially before the Help to Buy scheme comes to an end in 2023.

If you are thinking of moving, we’re here to help and advise at every step of the moving process. You can book a consultation with us, our advice is free and without obligation.

More Articles